The Startup Mentor

Ultimate Source of Advice and Inspiration for all the Starups!

Wednesday, February 1, 2012

Mentors: Unrealized Weapon of an Young Entrepreneur

Tuesday, January 17, 2012

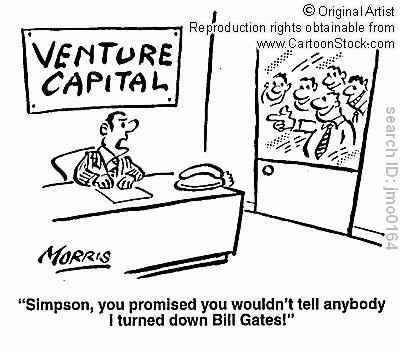

The State of Venture Capital in 2012

On balance, the VC industry is likely to end 2011 near the bottom of a decade of lousy returns for their limited partners. And with fundamental changes in the way startups operate and finance themselves, this decade of VC investment doom has created serious questions about whether venture capital can ever rise from the ashes.

Taking the long view of VC investing, 2011 looks like it will end with at most a quarter of the level of capital invested compared to its all-time 2000 high. In 2000, total VC invested hit nearly $100 billion -- growing at an annual rate of 68 percent since 1995 -- the year that Netscape went public, according to the National Venture Capital Association.

Meanwhile, when you subtract out all the fees and expenses from the returns that VCs generate for their limited partners, what you get is a surprisingly lousy return on investment.

For the decade ending June 2011, VCs earned an average of 1.3 percent for their long-suffering investors. Compared to returns from the Dow Jones Industrial Average (4.2 percent), the Nasdaq (2.5 percent) and the S&P 500 (2.7 percent), the historical statistics do not bode well for attracting new investment.

What's more, if you look at the 10 year return of VC funds -- they typically hold onto client money that long -- you see that returns to limited partners were negative in the decade ending each quarter between June 2010 and March 2011.

The one brightish spot for VC in 2011 -- that could carry over to 2012 -- was the post-IPO returns of seven prominent venture-backed start-ups. After all, by my calculations, those seven were up 2 percent on average through December 9. But that small increase masked wide variations between winners like LinkedIn, which is up 60 percent from its IPO and Demand Media, down 54 percent from its opening.

If you happen to be working on a startup that competes in a market segment where VCs have just made big gains, then the peer VCs who missed out will be eager to invest in your company in 2012. Otherwise, you could be in for a tough sell.

Starting a Business to Fund Your Startup Idea

Failing to secure investors, Casey and partner Corey Stanford instead opened a web consulting firm, Clariwebs, with the idea that they would use the profits from that venture to fund their true passion. After more than a year of bootstrapping, they dissolved Clariwebs and launched Blazetrak (along with a third partner, Ronald Harrison), bringing in revenue from day one. Two years later, the site boasts approximately 50,000 registered users from 202 countries and features commentary from 400 celebrities and experts. We asked Casey about making the transition from Clariwebs to Blazetrak.

How much of Clariwebs' revenue did you put into Blazetrak?

It wasn't a lot of money. Because we created this culture of bootstrapping, it only ended up being $10,000 or $15,000. We were using our own internal team to do a lot of the development work on Blazetrak. There was a lot of sweat that went into it.

How much time did you spend on each business?

We were probably 70 percent on the projects for Clariwebs. In the background, we were constantly building modules for Blazetrak. As we got closer to launching and it got more exciting, the amount of time we were spending on Blazetrak increased. By the final run, we were probably at 70 or 80 percent with Blazetrak.

Did you tell clients about the new business?

We did--particularly the ones we had established strong relationships with and who had become dependent on us for making decisions about their online businesses. It's hard, because you're trying to sustain and take care of customers for one business while in the back of your mind you're thinking about raising money for something else that you feel passionate about.

Any tips on starting a business to finance a product launch?

If you're starting a company or you're doing consulting specifically to raise money for a bigger idea, you have to be 100 percent vested in and committed to why you're doing it. The company that you're creating or the consulting work that you're doing to raise funds could be a big temptation once it starts making a lot of money. You can get really complacent. When we switched over fully to Blazetrak, that's when we started getting all these calls about potential jobs that would have been great if we were still doing Clariwebs. We were making $2,000 our first month on Blazetrak and thinking, "Wow--we could have taken a $30,000 or $40,000 Clariwebs project this month."

What's the biggest downside of funding a startup this way?

It's painful to use your own money, especially when you'd rather spend it on groceries. But that's what makes it a good thing. You get really smart with how you spend it. You say, "We really need to buy this software solution." And then you say, "Is this the right one? Can we find a cheaper version? Can we build it ourselves?"

You start to do a lot of research so you can spend less money or can learn a skill that will save you money over the long term. I figured out how to do our financials for Clariwebs by reading a book on QuickBooks. I use those skills even today.

We got so much out of Clariwebs that helped us with Blazetrak. A lot of the operational stuff, the staff and the work we did morphed over to Blazetrak. The value wasn't just monetary--we gained experience and relationships, too.

Monday, January 16, 2012

Why Crowdfunding is Bad for Business

Startup Mentor is a place for all the Startups to find their virtual mentors. The forum is dedicated to giving ideas to the aspiring entrepreneurs and the first generation entrepreneurs. If you fee that you can contribute to the community of entrepreneurs by providing your articles, opinions, analysis and case studies, please send an email to startupmentor@gmail.com

Sunday, January 15, 2012

Seven Tips for Becoming a Better Boss

Is better hiring and retention high on your to-do list this year? Many people need to do more with less nowadays. A great way to start is with bettermanagement and more effective workers.

It’s easy to see why companies would want to start building a great workplace. Where to begin can be more difficult to discern. This lack of clarity makes it tough to take focused actions that move a company forward. In some cases, it can even discourage leader if the scope and breadth seems too large to overcome.

If you’re among those aspiring to build a better workplace, even a great one, here are seven tips from the leaders of companies recognized in this year's annual Best Small Workplaces list.

1. Begin with yourself. “In order to build a great workplace, you must first build yourself by gaining a deep understanding of your strengths and weaknesses as a leader, and you must completely commit to developing yourself into the best leader and person you can be. At the same time, you must hire outstanding people who are as committed as you are to build a great workplace.” – Robert Pasin, Chief Wagon Officer, Radio Flyer

2. Flip the traditional management dynamic. “Treat every employee as a colleague, and turn the management structure upside-down. If you are hiring well, then the management of the company is there to support the talent and aspirations of your employees, and not the reverse.” – John Saaty, CEO, Decision Lens.

3. Hire the best. “Hire people smarter than you. This is the best advice my father gave me when I was starting my business, and I believe it holds true today. In today's competitive environment, your time at work will be easier and more pleasant if you are surrounded by smart people-- those who share your values, mission, and vision and like to have FUN! Talented employees will help your business to grow, and create a great place to work. Customers value knowledgeable employees -- the smarter your new hires are, the better off your business will be in the end.” -- Lauren Dixon, CEO, Dixon Schwabl

4. See employees as whole people. “Every employee has things in their life more important than work. If you fail to realize that, there will be a fundamental disconnect in your relationship with that employee. Realize it and embrace it, and you will be on the way to a mutually beneficial relationship. ” – Tim Storm, CEO & Founder, FatWallet

5. Use positive, constructive motivation. “It’s said that eight out of 10 people come to work in the morning wanting to make a difference, but by lunch it’s down to four. That’s usually a result of the environment more than anything, not just the physical but the interpersonal. Lead your employees with a clear vision, support them with adequate resources, and possibly most important – reward them for treating others with respect. Motivate everyone in a positive, constructive way, and your biggest problem will be having to build more office space sooner than you thought!” – Tim Hohmann, CEO, AutomationDirect

6. Practice accountability to your values. “Hold everyone accountable to your core beliefs and values, including you. No ‘license to kill’ is allowed no matter how much money someone brings into your business. Otherwise, a double standard develops which will derail the creation of a great workplace.” – Jim Rasche, 3EO, Kahler Slater

7. Start now. “Don’t wait till you get bigger to put in place key items, such as staff surveys, peer interviewing for hiring and clear standards of behavior [developed by staff].” – Quint Studer, CEO and founder, Studer GroupFriday, January 13, 2012

Innovation from Amazon, Starbucks and USPS

How do the big, name-brand companies stay on top? One answer is innovation. Besides acquiring smaller, innovative companies, most giant brands also put a lot of energy into research and development. So they're constantly testing out new ideas in every element of their business, from marketing strategy to products.

How do the big, name-brand companies stay on top? One answer is innovation. Besides acquiring smaller, innovative companies, most giant brands also put a lot of energy into research and development. So they're constantly testing out new ideas in every element of their business, from marketing strategy to products.

Here are three of latest and greatest ideas that recently caught my eye, which come courtesy of Starbucks, Amazon and UPS:

Starbucks recently opened a portable store in the Seattle area that's made from four stackable shipping containers. The store offers many possibilities. It's moveable like a food truck, but offers a different look and feel. Maybe they could plop it down in different cities, or as a test store in a prospective market. If customers don't come, they could try again a few blocks away.

At the same time, the store makes a statement about Starbucks' commitment to the environment. It's essentially a recycled store. On the exterior reads the company's motto: "regenerate, reuse, recycle, renew, reclaim." It also has a tiny footprint, under 500 square feet.

The company says it may use them in the parking lot while stores are being remodeled or constructed. What a great way to start building your audience before you open.

For its part, Amazon is testing out a new delivery method for its many packages -- PIN-based, self-service lockers they place at a nearby 7-Eleven or other 24/7 convenience store. If you're not home much, you could pop by your locker when it's convenient and keep your packages secure in the meanwhile. They're trying out these lockers in Seattle, New York and London.

UPS likes this idea, too -- they're testing "gopost" parcel lockers outside post offices in Northern Virginia. The lockers enable customers to receive high-value items such as smartphones in a secure way, then retrieve them anytime.

These news twists show how valuable it is to rethink every aspect of your business. Not all new initiatives should be about products or services. It'll be interesting to see how these innovations are received by customers.

Mark Cuban's 12 Rules for Startups

Anyone who has started a business has his or her own rules and guidelines, so I thought I would add to the memo with my own. My "rules" below aren't just for those founding the companies, but for those who are considering going to work for them, as well.

1. Don't start a company unless it's an obsession and something you love.

2. If you have an exit strategy, it's not an obsession.

3. Hire people who you think will love working there.

4. Sales Cure All. Know how your company will make money and how you will actually make sales.

5. Know your core competencies and focus on being great at them. Pay up for people in your core competencies. Get the best. Outside the core competencies, hire people that fit your culture but aren't as expensive to pay.

Related: Mark Cuban on Why You Should Never Listen to Your Customers

6. An espresso machine? Are you kidding me? Coffee is for closers. Sodas are free. Lunch is a chance to get out of the office and talk. There are 24 hours in a day, and if people like their jobs, they will find ways to use as much of it as possible to do their jobs.

7. No offices. Open offices keep everyone in tune with what is going on and keep the energy up. If an employee is about privacy, show him or her how to use the lock on the bathroom. There is nothing private in a startup. This is also a good way to keep from hiring executives who cannot operate successfully in a startup. My biggest fear was always hiring someone who wanted to build an empire. If the person demands to fly first class or to bring over a personal secretary, run away. If an exec won't go on sales calls, run away. They are empire builders and will pollute your company.

8. As far as technology, go with what you know. That is always the most inexpensive way. If you know Apple, use it. If you know Vista, ask yourself why, then use it. It's a startup so there are just a few employees. Let people use what they know.